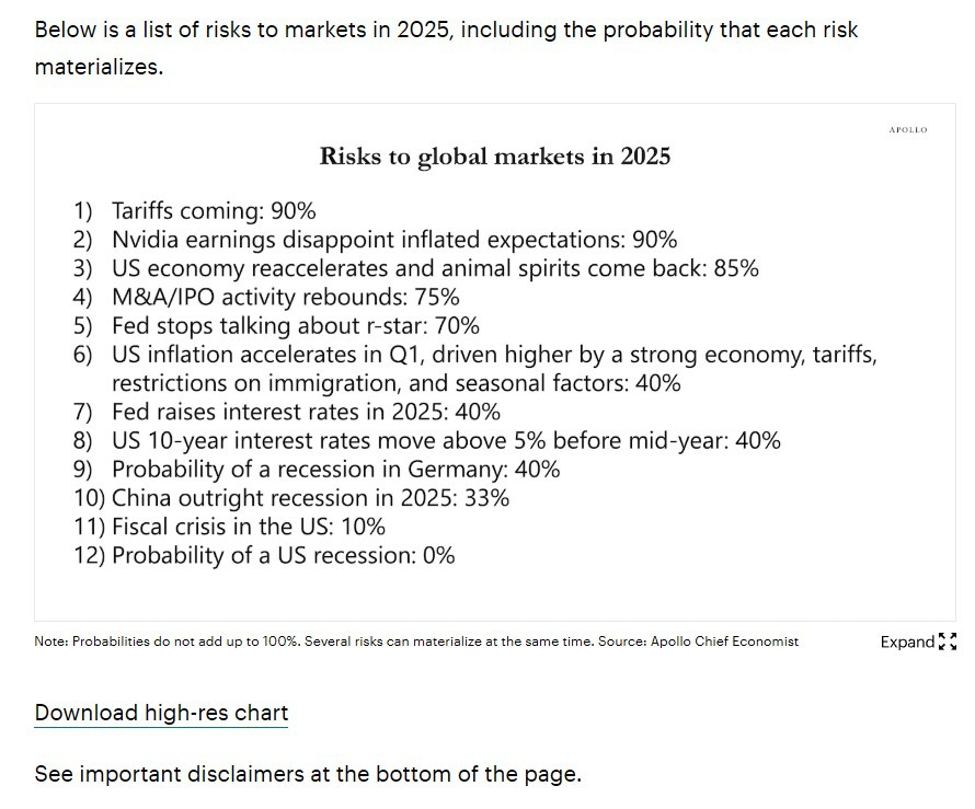

This is via Tortsten Sløk, Apollo Chief Economist (Apollo is a US asset management firm).

Also, from the firm’s 2025 outlook, some reasoning (in very brief) why Federal Open Market Committee (FOMC) rates could rise:

- It is too early to assess the impact of potential new policies following Donald Trump’s election as US president. That said, if implemented, his key policy objectives—lower taxes, higher tariffs, and reduced immigration—could increase rates, boost asset prices, drive inflation, and strengthen the dollar.

This article was written by Eamonn Sheridan at www.forexlive.com.

Source link